Investigative

Reporting

Award 2015 Nominee

Unholy Alliances

Dejan Milovac (MANS)

Stevan Dojcinovic (CINS)

Montenegro: Football, Politics, and Cocaine

The Mogren Football Club of tiny Budva, Montenegro thrilled fans in 2009, winning the Montenegrin First League title and qualifying for a chance at the UEFA Champions League for the first time.

The team did well but lost in the second round of qualifying play in mid-July. But team officials conspired only two days later to deal the club a far bigger blow: the club director gave away the land used as the team’s longtime stadium, which sits on a valuable piece of property just 50 meters from the sea in the heavily built-up tourist haven of Budva. It is the only large tract of land near the beach remaining in Budva.

The land was publicly owned and not his to give.

The deal remained secret for three months, until the contract was mysteriously distributed as a flyer across Budva naming the new owners. Faced with public scrutiny, the director said the investors, a man from France and one from Switzerland, would present a design for the land in a few months.

He lied, and with a reason.

Business records obtained by the Organized Crime and Corruption Reporting Project (OCCRP) show that club director Boro Lazovic had made a secret deal with Darko Saric, the indicted leader of a powerful Balkan criminal organization that has for years trafficked cocaine from South America into Europe.

The deal is one of many in Montenegro that has linked business, government and organized crime in a tightly wound relationship. These unholy alliances have increasingly given Montenegro an international reputation as a criminal state.

Public Land in Private Hands

Rajko Kuljaca, former mayor of Budva for many years headed the board of the Mogren football club. In January 2009, Kuljaca and club director Boro Lazovic signed a contract to make the transfer of the public land.

Rajko Kuljaca, former mayor of Budva for many years headed the board of the Mogren football club. In January 2009, Kuljaca and club director Boro Lazovic signed a contract to make the transfer of the public land.

Mogren has had all it takes to be a successful club. It has loyal fans, is owned by the local municipality, is well-financed by local authorities, and its board was then headed by Rajko Kuljaca, who had always been a supportive mayor. Lazovic, the club director, is well known in Budva as an influential local businessman and head of the Budva branch of the ruling Democratic Party of Socialists (DPS), the party run by Milo Djukanovic, Montenegro’s Prime Minister and the man who decides everything in the country.

In 2007, the city said it would give the club a new home and a new stadium to replace the basic facility where the team played. In November of that year, local authorities decided to deed the football club nearly 80,000 square meters of land, the size of 11 standard football pitches, located in a remote area on the slopes of Dubovica Hill.

The city also gave the club a far more valuable piece adjacent to their current stadium. That land, valued at €7 million (US$9.75 million), is located in the Lugovi area of Budva, just 50 meters from the beach next to the tourist complex Slovenska Beach, named after a group of Czech tourists who spent their holidays there in 1935. Lazovic promised in local newspapers that the club would not sell their new and valuable public land.

View the plan for relocation of the stadium

The gift was made despite protests from the opposition and the descendants of the land’s former owners. Following World War II, the Communist regime had confiscated the land and other assets of rich families. In March 2004, Montenegro had passed a law allowing the return of unused land, and various families opened proceedings to get their land back. So far they have failed.

But despite the decision, local authorities waited more than one year until January 2009 when Mayor Kuljaca and club director Lazovic signed a contract to make the transfer. Lazovic was true to his word that he would not sell the land. Instead, he gave it away.

Less than a month after the transfer, before the new land had even been officially registered in the name of the club, Lazovic signed a partnership deal with two companies: Nova Star CG and Amsone Enterprises Montenegro. The deal transferred the land near the beach and the rest of the club’s coastal land including its stadium, a total of 20,000 square meters, to a company that had not yet been formed, called Novastar Investment CG. Lazovic also threw into the deal an additional 8,000 square meters of adjacent beachfront land that was owned by the state. The contract does not provide details on how the club would get that additional public land, and appears to ignore the law requiring a public tender for the sale of public land.

View the plan for the new development

Not only did Lazovic give away the club’s publicly owned land, he never asked or got approval from the club’s board or from local authorities, as required by law.

According to the contract, the two companies and FC Mogren would join together to form Novastar Investment CG. Amsone Enterprises Montenegro would administer the project, while Nova Star CG would pay for construction of a mixed residential and commercial complex on the land which would include two towers and a business center. The investment company would also pay for a 15,000- seat stadium on the club’s land in the hills. It did not specify where the money would come from. But according to its financial reports, the company had no income or other sources of money and began piling up losses from day one.

The first director of Novastar Investment CG, and the man Lazovic signed the contract with, was Bosko Krlovic, an employee whose usual job for the football club was mowing the grass.

Krlovic refused to comment.

Mixing Politics with Cocaine Money

The first director of Novastar Investment CG, at the time majority owned by drug kingpin Darko Saric, was Bosko Krlovic, an employee whose usual job for the football club was mowing the grass.

Krlovic – Photo: Facebook

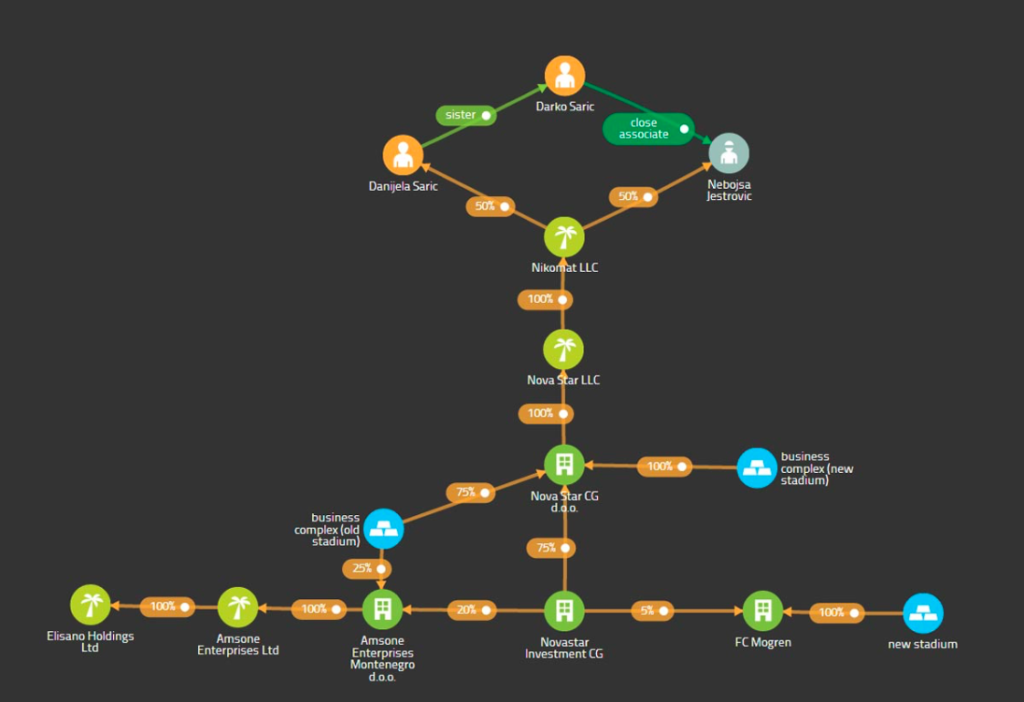

Novastar Investment CG was incorporated in Montenegro in March 2009, three weeks after the deal was signed, listing road and highway construction as its primary business activity. The publicly owned Mogren football club owned just 5 percent of the company despite putting millions of dollars’ worth of prime coastal property into the deal; Amsone Enterprises Montenegro, 20 percent; and Nova Star CG the remaining 75 percent.

Amsone Enterprises Montenegro is owned by a similarly named Cyprus company, which is in turn owned by Elisano Holdings Limited, a company incorporated in the British Virgin Islands, a secretive offshore jurisdiction often used to hide ownership. Montenegrin authorities did not release all records they had on the company.

While the owner of this company remains unknown, OCCRP tracked down who was behind Nova Star CG, the biggest shareholder.

Incorporation records show Nova Star CG is owned by Nova Star LLC, which, in turn, is owned by Nikomat LLC. Both companies are registered in the US state of Delaware, another jurisdiction commonly used by criminals in the Balkans and Eastern Europe to hide their illegal proceeds. Nikomat LLC is jointly owned by Saric’s sister, Danijela, and his childhood friend, close associate and best man, Nebojsa Jestrovic, who was indicted in Serbia in 2010 for being Saric’s chief money launderer. Jestrovic is currently on trial.

Blagota Radulovic, director of drug lord Darko Saric’s company Nova Star CG, is a former employee of the Montenegrin Investment and Promotion Agency and currently deputy minister and the head of the Sector for Payment at the Ministry of Agriculture and Rural Development of Montenegro.

The Director of Nova Star CG is Blagota Radulovic, a former employee of the Montenegrin Investment and Promotion Agency and currently deputy minister and the head of the Sector for Payment at the Ministry of Agriculture and Rural Development of Montenegro. Radulovic ran a project at the Ministry that has been implicated in a vote buying scandal for Djukanovic’s DPS party using World Bank funds although no charges have been filed.

Radulovic could not be reached for comment.

Radulovic – Photo: Bulgaria Economic Forum

In late October 2009, when the contract was leaked to the public, the families who had formerly owned the land expressed outrage. Budva officials said they knew nothing of the deal.

Lazovic told the Montenegrin daily newspaper Vijesti on Oct. 29, 2009, that the club would get a brand new 15,000-seat stadium and a 5 percent cut of the yet-to-be-designed real-estate project. But the actual contract showed the club would not have any ownership of the new residential and business complex on the beach. That would be one quarter owned by Amsone Enterprises Montenegro and its secret owner and three-quarters owned by drug lord Saric. In addition, they planned to build a second complex next to the new stadium, but again the club would be left out and would not own any share in that complex, that would be fully owned by Saric’s Nova Star CG.

Lazovic never mentioned Saric, but claimed he couldn’t remember the names of the investors at first, describing them as two men from France and Switzerland. He later changed the story to say it was a French-Swiss company.

He did reveal one other detail: that the deal signed six months earlier was actually arranged in early 2008. That corresponds with the period when Saric started to pour his drug money into Montenegro, according to indictments in different countries.

“A year and a half ago we had a concrete deal. It was supposed to be in motion, but the crisis happened,” said Lazovic, referring to the global financial crisis of 2008. “The question is whether they are willing to enter into these investments, because they are not small.”

Lazovic could not be reached for comment.

The director of Mogren football club Boro Lazovic is well known in Budva as an influential local businessman and head of the Budva branch of the ruling (DPS). He gifted the club’s land to Darko Saric.

Lazovic – photo: Vijesti

The director of Mogren football club Boro Lazovic is well known in Budva as an influential local businessman and head of the Budva branch of the ruling (DPS). He gifted the club’s land to Darko Saric. (Photo: Vijesti)

Another crisis that had nothing to do with global finance had also occurred. Just two weeks earlier, in early October 2009, more than two tons of Saric’s cocaine were seized near the Uruguayan coast on a luxury yacht. Saric evaded arrest despite months of surveillance by the police and was on the run for more than four years until his arrest in March 2014.

In early 2010, Nova Star CG’s shares in the company were transferred to Panama-based Adriatic Overseas Holdings. Adriatic Overseas Holdings is an important company that ultimately connects Darko Saric, Serbian businessman Stanko Subotic and Milo Djukanovic, three people who were intimately tied together through First Bank and a series of real estate deals.

For example, Adriatic Overseas Holdings took over the bankrupt San Investments, a company that Central Bank documents say is among a group of companies owned by Subotic, a controversial Serbian businessman and close friend of Djukanovic. In October 2009 Saric did Subotic’s company a great service when he provided money to secure loans for San Investments through First Bank, the bank owned by Djukanovic’s family.

Blagota Radulovic (left) and Petar Ivanovic (right) have worked together for several years, first at the Montenegrin Investment and Promotion Agency and currently at the Ministry of Agriculture and Rural Development of Montenegro. Both have been linked to drug lord Darko Saric.

Radulovic and Ivanovic – Photo: MIDAS

The real ownership of Adriatic Overseas Holdings is unknown, but one man who knows the truth is the current Minister of Agriculture of Montenegro, Petar Ivanovic, a man close to the Prime Minister and a professor at his private university. Ivanovic’s employee, Blagota Radulovic was the director of Saric’s Nova Star CG. He was also previously the director of the Montenegrin Investment and Promotion Agency where Radulovic also worked as his employee.

Djukanovic has been closely associated with Ivanovic and the issue of foreign investment for years. In December 2013, Djukanovic’s government appointed Ivanovic to the Council for Foreign Investments, which is chaired by the prime minister himself.

According to a letter found in the Montenegrin business records, a power of attorney document for Adriatic Overseas Holdings was sent to Ivanovic’s home address in Montenegro by the Panamanian registration firm that incorporated the company. The letter said Adriatic Overseas Holdings instructed them to send the documents to him, indicating Ivanovic is somehow related to the company.

The power of attorney for Adriatic Overseas Holdings was in the name of Zorica Djukanovic (it is not clear if she is related to the prime minister). The lawyer, like many people involved in the deal, is tied to both the Djukanovic family and Darko Saric. Zorica Djukanovic previously represented Aco Djukanovic, the brother of the prime minister, in a real-estate deal. She also defend a Saric associate named Jovica Loncar who was accused of laundering Saric’s drug money, as well as the widow of Dragan Dudic, a Saric associate murdered in 2010 in Kotor in Montenegro.

Petar Ivanovic, Minister of Agriculture and Rural Development of Montenegro, received documents for Adriatic Overseas Holdings at his home address in Montenegro. The company took over drug kingpin Darko Saric’s stake in the development deal.

Ivanovic – photo by: MIDAS

There are other connections between Ivanovic and Saric. Montenegrin daily Dan revealed last year that Ivanovic traveled to France with Saric associate Loncar. Dan revealed records from the travel agency showing that the tickets for both men were bought at the same time and place by the same person and that Saric paid. Ivanovic told Dan he did not know Saric and said he sees no reason for further communication.

Ivanovic did not agree to an interview with OCCRP.

In January 2011, Montenegrin police seized documentation on the transfer of public land to the FC Mogren club and started an investigation of club officials. Their investigation was completed and a report sent to the Montenegrin Supreme State Prosecutor for Organized Crime. The prosecutor has not acted in more than three years on the case.

In March 2012, Lazovic announced, “The foreign company gave up on the project because they couldn’t find funding for the investment.”

The club registered the land in its name in 2012 but the project is still ongoing and the government approved the development last year. Meanwhile, the status of Adriatic Overseas Holdings in the contract is still not clear and all records are being held by the prosecutor. Who owns the development now and where the money will come from is, like so many things in Montenegro, also not clear.

Along with Mogren fans, the other losers are the descendants of the original land owners. They didn’t want to talk on the record because they are still fighting for their land, but in several interviews members said that the city had a legal obligation to return the land but has instead done everything they can to stop the return. Said one: “Behind this are people who are connected through family and best friends. If someone does not want to return assets then they will do everything make sure that does not happen.”

Montenegro: Prime Minister’s Family Bank Catered to Organized Crime

Know Your Drug Dealer

When opening accounts for new clients, banks are required by law to follow “know your customer” rules and obtain detailed records that confirm the identity of the person who truly owns or benefits from the account. The rules are in place to prevent banks from being used for money laundering.

First Bank routinely and in many cases systematically failed to collect the required information.

Darko Saric, the recently arrested drug lord who police and prosecutors say ran an international cocaine smuggling ring, did extensive business through the First Bank of Montenegro, owned by the country’s ruling family.

For example, when setting up accounts for Delaware-based Lafino Trade LLC and Seychelles-based Camarilla Corporation, the First Bank failed to obtain valid copies of registration records as well as copies of identification cards for people with access to the accounts. Both companies were controlled by Darko Saric and both were used for money laundering, according to prosecutors.

In May 2012, Dusko Saric, Darko’s brother was sentenced to eight years in prison for money laundering. It was through Camarilla Corporation’s bank account in First Bank that Saric’s brother laundered €7.4 million (US$ 10 million). Dusko Saric appealed and his sentence was changed to five and a half years in December 2013.

Reporters at OCCRP obtained documents from the Delaware business registry which shows that the Saric brothers are shareholders of Lafino Trade. This is confirmed by law enforcement records and court documents, which show the company was used to launder Saric’s drug profits to funnel them into legitimate businesses.

For instance, Lafino Trade showed up in an OCCRP investigation into Zoran Copic, a Serbian businessman sentenced in Bosnia and Herzegovina (BiH) in January to four and a half years in prison for laundering Saric’s money. Copic was also sentenced to six years in prison in absentia in Serbia in February. In December 2008, US$ 2.9 million was transferred from Lafino Trade to the account of Agrocoop, a company owned by Copic, which he used to purchase a sugar factory in Bijeljina, BiH.

Saric was an important customer but it is not clear how much money he had on deposit. In 2010, Montenegrin Central Bank examiners reviewed the accounts of foreign entities in First Bank. The company Lafino Trade was listed among the top 10 foreign accounts posting the largest number of transactions although the report does not mention exact amounts. It also had the 13th largest amount of money on long-term deposit. Lafino Trade deposited €6 million (US$ 8.25 million) as a 5-year deposit on May 6, 2008.

Lafino Trade was used by Saric when he sold the Serbian cigarette and news distribution company, Stampa System, to the German media concern WAZ for €29 million (US$ 40 million).

In May 2012, Dusko Saric was sentenced to eight years in prison for money laundering through First Bank of Montenegro. He appealed and his sentence was changed to five and a half years in December 2013.

While all banks are obliged to report suspicious transactions to the Anti-Money Laundering Agency of Montenegro, First Bank never reported a single suspicious transaction from Lafino or Camarilla, according to testimony at the trial of Dusko Saric by Predrag Mitrovic, head of the agency at the time.

Nova Star CG, a subsidiary of another Delaware company owned jointly by the sister of Darko and Dusko Saric and Nebojsa Jestrovic, Saric’s close associate and best man, who was later indicted for money laundering for the drug dealer, channeled money through the bank. In April 2009, First Bank provided confirmation that the Saric company has at least €1 million (US$ 1.3 million) deposited in its account at the bank. The company was used in a land deal with the Budva football club Mogren.

But this was not the only business First Bank transacted with Saric. Despite poor financial returns, First Bank gave loans to two Montenegrin companies controlled by Saric: Mat Company and Trecom.

Jovica Loncar was a proxy for Darko Saric, the indicted drug lord. He served as a front person for companies that Saric established in Montenegro and Delaware. First Bank gave two loans to Mat Company, a company registered in 2006 for retail trade. The company was established by Dusko Saric but in 2009 Dusko was replaced by Darko Saric, then Darko was replaced in the same year by the company Mateniko LLC from Delaware. According to a Serbian investigation, Mateniko was heavily used for money laundering. Finally, in late 2009, Mateniko was replaced by Jovica Loncar, a front person for companies that Saric established in Montenegro and Delaware.

First Bank gave Mat Company a €5 million (US$ 6.87 million) 3-year loan on May 3, 2008 with a grace period of three months. The loan was secured with a mortgage on 266 square meters of land in Budva and the hotel Max Prestige (4-story, 1,014 square meters) estimated at €8.1 million(US$ 11 million). Additionally, the loan was secured with €5.4 million (US$ 7.4 million) worth of movable assets. The source of repayment was to be business income. A second 3-year loan in the amount of €300,000 (US$ 412,000) was approved in February 2008 with a 12-month grace period. The purpose of the loan was working capital for the company.

An analysis from Central Bank examiners showed that at the end of 2007, Mat Company had low profitability. It also had a low level of liquidity, according to a January 2009 report. A 2010 examination by the Central Bank along with an analysis of financial statements for 2008 and 2009 showed the company was chronically losing money. Because of the high losses, it had little cash and took out more short-term loans and at the end of 2009 had €500.000 (US$ 687,000) in losses.

Trecom, another company controlled by the Montenegrin drug trafficker’s network, also got a 5-year loan with a 12-month grace period. While it is not clear what the original amount of the loan was, at least €1.2 million (US$ 1.6 million) was outstanding as of 2010.

Trecom was founded by Radulovic, who worked with Saric. Radulovic later transferred Trecom to Dudic, another of Saric’s partners, who was under investigation by Serbian prosecutors for cocaine trading.

Aco Djukanovic is the biggest shareholder of First Bank of Montenegro which Darko Saric helped by depositing millions at a time when it was struggling to meet the demands of customers for their money.

Lafino Trade helped out First Bank significantly. When it deposited €6 million (US$ 8.25 million) for five years in May 6, 2008, the deposit came at a very good time for First Bank, which was already struggling to pay its bills and depositors. Compared to other top depositors, Saric’s deposit had an unusual provision; while other depositors were paid interest of 5 to 8 percent, Lafino received only 1.5 percent. Normally, depositors who agree to leave money in a bank for a long time are paid higher rates. The only other depositors with such a low interest rate were bank owner Aco Djukanovic (1.5 percent) and Caldero Trading Limited (2 percent) a company owned by Milo Djukanovic’s close friend Zoran Becirovic.

While Saric may have been the biggest criminal working through First Bank, he is not the only controversial figure who used the bank. OCCRP has reported that indicted cigarette smuggler Brano Micunovic and his wife got very good deals from the bank including an unsecured line of credit. Montenegrin non-governmental organization MANS has reported that Albanian drug kingpin Naser Kelmendi was allowed to make large cash deposits at the bank. OCCRP will publish tomorrow a story about the relationship between the bank and Stanko Subotic, a Serbian businessman who was indicted in Serbia for abuse of office related to the smuggling of cigarettes.

Montenegro: Buying up Paradise (Part 1)

Favor for an Old Friend

Serbian businessman Stanko Subotic and Montenegrin Prime Minister Milo Djukanovic go back a long way, ever since the late 1990s when Montenegro was a smuggling haven. Both were indicated for cigarette smuggling by an Italian court. Subotic was acquitted in 2013. Djukanovic invoked diplomatic immunity.

Djukanovic and Subotic – photo by Vijesti

The Villa Montenegro made local headlines that year when it became the first and only Montenegrin hotel to win the Five Star Diamond award of the American Academy of Hospitality Sciences (AAHS).

The award was not quite all it seemed. Its sponsoring organization, the AAHS, is a public relations and lobbying group that helps promote hotel properties.

But in Montenegro, it helped bolster Subotic’s reputation as an up-and-coming entrepreneur in the tourism field. The country is a fragment of the former Yugoslavia the size of the US state of Connecticut with a population of about 620,000. It lies across the Adriatic Sea from the heel of Italy’s boot. While its biggest city is the capital, Podgorica, its tourism business is centered on several ancient towns on the seacoast.

The country’s tourism capital is Budva, a town of fewer than 20,000 that predates the Roman Empire. Four miles down the coast lies the even tinier town of St. Stefan, once the haunt of Hollywood royalty like Sophia Loren, Richard Burton and Elizabeth Taylor. Budva and St. Stefan share certain characteristics: beautiful situations on the Adriatic Sea, exquisite islands lying just offshore, and a proven track record of attracting well-heeled tourists.

Subotic had big plans for both of them.

Born into a working-class family in the Serbian village of Kalinovac, Subotic worked in his father’s carpentry business before moving to France to work as a tailor. By the time Yugoslavia broke apart, he was home and investing in textiles. He made his fortune in the mid-1990s in duty-free shops he opened on the border between Serbia and Macedonia.

He became the exclusive distributor of major cigarette brands including Philip Morris and British American Tobacco. In 1997 he relocated his business to Montenegro, then under an UN-imposed trade embargo, and became friendly with Djukanovic and Marovic, who have essentially controlled Montenegrin politics for the past two decades.

There were others interested in the cigarette business at that time. Two Italian organized crime syndicates, the Neapolitan Camorra and the Sacra Corona Unita (United Sacred Crown, from the Apulia region in Italy’s southeast), also set up operations in Montenegro.

And it was big business. At the time, cigarette smuggling was endemic in the Balkans.

Most nights, dozens of large speedboats crammed with cigarettes made the two-hour crossing from Montenegro to Italy, where the syndicates sold the untaxed cigarettes on the Italian black market. According to Ratko Knezevic, a former associate of Djukanovic, the Montenegrin government gained as much as $700 million annually from cigarette smuggling by the end of the 1990s.

Prosecutors believed Subotic helped the Italian criminals smuggle cigarettes and both he and Djukanovic were charged with smuggling in 2008. The following year, Italian authorities dropped the charges against Djukanovic, noting that he had diplomatic immunity. Subotic was acquitted in 2013 in the Italian case, but continues to face charges in Serbia connected to smuggling.

A main line of defense for the accused was that the illicit cigarette trade took root during the three-year economic blockade of Serbia and Montenegro, stemming from ethnic unrest in Kosovo. Djukanovic consistently told investigators that smuggled cigarettes helped his countrymen survive, and that he had not benefitted personally from his country’s part in the illicit trade.

Subotic told a television interviewer in 2010 that “Djukanovic did not help (him) much with the cigarette business, but rather (Subotic) did a favor to Montenegro by choosing it for transit.”

Years later, Montenegro paid the favor back.

In November 2006, four months before the glittering party at the Villa Montenegro, Djukanovic’s brother Aco had privatized a small bank in his home town of Niksic. He paid a fraction of its worth, €2.3 million (US$3.1 million), and named it First Bank. Soon after, local, state and national government authorities began pouring in nearly €100 million (US$133 million), making First Bank one of the country’s biggest.

Companies owned by Serbian businessman Stanko Subotic received at least €21 million in loans in 2007 from the First Bank of Montenegro. The bank is controlled by family of his close friend, Prime Minister Milo Djukanovic.

Photo by Vijesti

As public money rolled in, the brothers’ friends, partners and business associates started to form companies that let them dip into the windfall. They formed new companies that despite having no history got huge, often unsecured loans with favorable terms that they used to buy up valuable coastal real estate.

Subotic was among those who benefitted the most.

In December 2006, a month after the bank began churning out loans, Subotic launched what would be a yearlong burst of development activity.

It began with the formation of Samuelson Corporation, a real-estate investment company based in the Seychelles, off the coast of Africa.

This tiny island state in the Indian Ocean is often used to hide ownership and evade taxes and is among the most opaque and secretive tax havens in the world, according to the 2013 Financial Secrecy Index. Shareholders don’t report their identity to anyone, not even local authorities. However, other evidence indicates that the company was owned by Stanko Subotic.

Serbian businessman Stanko Subotić bought St. Nikola island in March 2007. The lovely, uninhabited island lies a kilometer off the coast of Budva. Locals call it the Montenegrin Hawaii because of its three fine sand beaches, dramatic cliffs and flocks of rare birds.

Photo by OCCRP

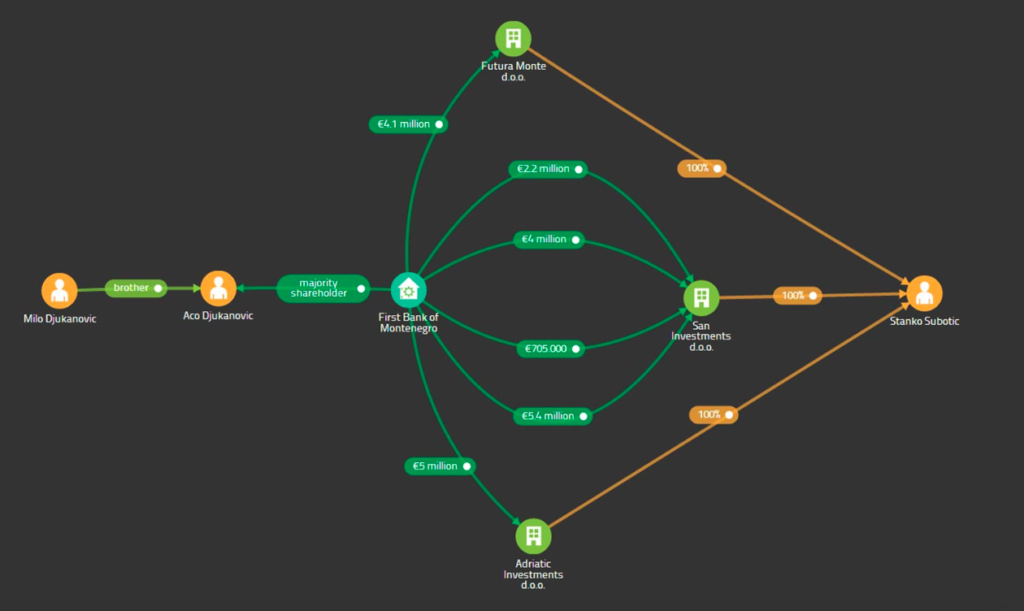

Two months later, on Feb. 5, 2007, Subotic through a subsidiary received a €2.2 million (US$2.85 million) loan from the Djukanovics’ bank. It was used to buy 6,300 square meters of land – a plot nearly the size of a standard football pitch – in St. Stefan close to his Villa Montenegro. The highly unusual four-year loan with a 12-month grace period went to San Investments, Samuelson’s local fully owned subsidiary, which was incorporated just 11 days before the loan was made. Subotic announced he was planning to build a six-star hotel worth €20 million (US$26.6 million) on the new plot of land.

With a steady supply of funds from First Bank, Subotic’s land-buying spree continued. But this time his focus was about four miles to the northwest: the lovely and largely uninhabited island of St. Nikola, which lies a kilometer off the coast of Budva.

Locals call it the Montenegrin Hawaii because of its three fine sand beaches, dramatic cliffs and flocks of rare birds.

In March 2007, San Investments signed a contract to buy three connected plots of land on St. Nikola. The company gained full title to a plot of 7,000 square meters (the size of a standard football pitch), and a one-third share in two plots totaling more than 90,000 square meters. For this, San Investments agreed to pay a total of €24 million (US$ 32 million) — €3 million by April, and the remaining €21 million by May.

The seller was Nenad Djordjevic, a Serbian businessman who had bought the land in 2001 from local residents for US$ 216,750. He built a dock, an artificial beach, and began building a hotel complex all without permits. He decided to sell the land after years of failing to get the required paperwork from local authorities controlled by Marovic.

Despite the contractual obligation to pay the full amount in less than two months from the date of purchase, it took Subotic until December to actually pay for the land and register the new ownership.

In April 2007 the Samuelson Corporation, San Investment’s Seychelles owner at the time, wired €3 million as a loan in time for the first payment. It is not clear how the second installment of €21 million was paid, but Subotic’s companies took out loans of €19 million from First Bank between April and December.

In May, Subotic threw another gala at his Villa. This time Djukanovic and Marovic were joined by another special guest: French architect JeanMichel Wilmotte.

Wilmotte unveiled his plans for a super resort with hotels, casinos and apartments, two marinas for yachts and a pedestrian causeway connecting the island with Budva’s old town.

“This marina will outshine all the marinas in the Mediterranean,” Wilmotte, who has designed marinas in Cannes, Nice and Shanghai, told the Montenegrin daily Vijesti.

“I saw the project and I liked it,” Djukanovic said in an interview with local IN television.

That kind of support prompted local authorities to change their own master plan, the document that maps out what a city will look like in the future, so it would accommodate the grandiose design.

Again it appeared as if the audacious plan to make Budva a new Monte Carlo, and Montenegro a new Monaco, was going to happen.

Almost.

An Inconvenient Warrant

Subotic’s efforts were similar to a welltested Montenegrin model for accumulating massive wealth in a short period of time. In that model, a person starts a new company that purchases land through favorable loans from a friendly bank with deferred interest and lump sum payments due later and with no or inadequate collateral. Then they seek other developers to buy or invest in the projects and use that money to pay off the loans before interest was due. If the deal went well they could make a very good profit without using any of their own money. But if it went bad, the company, like so many others at First Bank, would go bankrupt and they could walk away leaving the bank with the bill.

But for the plan to work an investor with deep pockets had to be found.

“An investor is being looked for,” Djukanovic told TV IN on May 18, 2007. “I don’t care who it is. It is important that someone invests a billion.”

But then, just months into Subotic’s development spree, the past came calling.

On June 20, 2007, the Serbian Special Prosecutor’s Office for Organized Crime issued an international arrest warrant describing Subotic as the leader of an organized crime group which smuggled and illegally sold cigarettes between 1995 and 1996. Prosecutors say the scheme cost Serbia €40 million (US$ 55 million) in lost tax revenue during that period.

Two weeks later, Subotic was a wanted man in most of the world’s countries after Interpol published a Red Notice alert asking member nations to arrest and extradite him to Serbia.

Subotic said the charges were false and politically motivated. Prosecutors eventually charged him with abuse of office of a private company, an outdated charge seldom used since the socialist era. They say he misused his position to allow his company to smuggle cigarettes and was convicted and sentenced to six years. However, a higher court ordered a retrial which is ongoing.

Subotic at the time was living in Switzerland and attempts by Serbian authorities to extradite him failed. Serbian authorities later claimed he was traveling often in Montenegro, but that country’s police and intelligence authorities said they had no idea where he was.

Business, however, proceeded as usual.

One day after the arrest warrant was issued, the Samuelson Corporation wired €250,000 (US$ 335,500) to San Investments account at First Bank. It was a loan, according to the records. By the end of August four more loans totaling €8.4 million (US$ 11.35 million) came into the account, for a total of €11 million (US$ 14.77 million). Records do not reveal how much of that stayed in the bank or if some or all of it was used to pay for the island.

With no earnings, millions in debt and its owner on the run, San Investments needed still more money. Subotic turned to his old friends again. On Oct. 11, 2007, the Djukanovics’ bank approved two shortterm loans totaling €4.7 million (US$ 6.68 million) to San Investments.

Subotic was indicted on Dec. 5—but despite that on Dec. 31 the bank approved yet another loan of €5.4 million (US$ 7.8 million) to San Investments.

San Investments ended the year €37 million (US$ 54 million) in debt, according to its financial statements. It also had acquired assets worth €33.7 million (US$ 49.2 million).

On Jan. 14, 2008 San Investments engaged in a swap with the other co-owners of the 90,000 squaremeter tract on St. Nikola. When it was completed, San Investments held full title to more than 37,000 square meters of the best property on the island.

On the same day, San Investments signed a mortgage agreement for the island with First Bank totaling €19.2 million (US$ 28.7 million). The mortgage included two additional loans worth €9.1 million (US$ 13.5 million) for his other two companies – Futura Monte, which ran a chain of kiosks, and Adriatic Investments, a holding company.

It took less than a year for Subotic and his companies to become one of the bank’s largest debtors. The risky lending caught the attention of the Central Bank of Montenegro, which regulates banks. And things started to unravel fast.

Montenegro: Buying up Paradise (Part 2)

Plans to turn the ancient coastal town on Budva into a new Monte Carlo collapsed leaving taxpayers the ultimate bill.

Island of St. Nikola is located lies just a kilometer off the coast of Budva. Locals call it the Montenegrin Hawaii because of its three fine sand beaches, dramatic cliffs and flocks of rare birds.

Photo by Vijesti

Serbian businessman Stanko Subotic tried to turn Montenegro into the new Monaco by buying the choicest coastal property and promising luxury resorts. But to do it he borrowed almost €21 million (US$ 30.66 million) from the Prime Minister’s family bank – loans that were often not secured and required lump sum repayments. As the single largest debtor to the bank, it put both him and the bank in a precarious position. If he were to fail, he would bankrupt himself and maybe the bank — a bank that held huge amounts of government money.

Subotic’s loans made the Central Bank, Montenegro’s chief regulator, nervous. And they had good reason to be so.

Bad Loans Backfire

Seven secret reports OCCRP obtained show that the First Bank of Montenegro repeatedly broke the law and approved loans against its own policy and in violation of good banking practice to benefit a number of Djukanovic’s business partners, including Stanko Subotic.

Photo by Vijesti

Between 2007 and 2010 the Central Bank sent six teams of top-notch examiners and hired auditor PricewaterhouseCoopers (PwC) to look into the operations of First Bank.

They found a lot.

Seven secret reports OCCRP obtained show that the family bank repeatedly broke the law and approved loans against its own policy and in violation of good banking practice to benefit a number of Djukanovic’s business partners, relatives and friends. Some of the biggest violations included the loans to Subotic’s companies.

At the time the first loan was approved, Subotic’s San Investments was newly formed and had no income, or business plan, which are basic requirements for banks to even consider a loan. And it approved a long grace period before making any payment due.

Other San Investment loans also were problematic, and some even allowed lump sum payment at maturity. First Bank kept poor documentation and could provide no evidence for its claim to examiners that San’s loans were secured with deposits.

While fully aware the total value of loans given to San Investments by far exceeded the allowed limit – 25 percent of bank’s own capital – the Djukanovics’ bank hid this information from examiners to avoid sanctions.

In one instance, the bank said it had given only one loan to San Investment, while examiners found four. On a number of occasions, the Central Bank ordered First Bank to stop its risky practices and comply with the law.

It did not.

With millions locked up in bad loans, in January 2008 the bank started experiencing liquidity problems. At the same time, international markets were roiling and international stock markets started a decline that would wipe out one third of their value. The Great Recession was starting and investment money dried up overnight. Real estate prices went into freefall. By the spring, First Bank was in serious trouble and unable to honor withdrawal requests from depositors. Much of the government money loaned out to Djukanovic’s friends had been lost.

On April 28, 2008, Subotic was arrested at Moscow’s Sheremetyevo Airport. Despite Interpol’s Red Notice, he had had no problems getting a visa. Serbia requested his extradition, but Russia refused and two months later, on June 26, Subotic was released.

Help from a Drug Lord

A company owned by Darko Saric, who led a powerful Balkan cocaine trafficking group, put up €4.2 million in collateral for San Investments owned by Stanko Subotic.

A company owned by Darko Saric, who led a powerful Balkan cocaine trafficking group, put up €4.2 million in collateral for San Investments owned by Stanko Subotic. (Photo: Vijesti)

At the time of his release, San Investments had at least €7 million (US$ 11 million) in its account at the First Bank.

But by the end of October 2008 this collateral was replaced with a new one of €4.2 million (US$ 5.9 million). According to a Central Bank report, the new money came from Lafino Trade, a Delaware-based company owned by bothers Dusko and Darko Saric. Darko Saric led a powerful Balkan criminal organization which had for years trafficked cocaine from South America into Europe. He is charged in Serbia with smuggling more than five tons of cocaine and laundering more than €20 million (US$ 27.6 million).

Media in the region have long speculated on a connection between Saric and Subotic. In a September 2009 letter to the Argentinian Federal Police, the US Drug Enforcement Administration (DEA) identified a person named Stanko Subotic as a member of Saric’s criminal organization. DEA would not return requests to confirm the identity.

Subotic in a later interview said he knew Saric but never did business with him. The Central Bank report is the first public evidence of an association.

Fall of an Empire

Serbian businessman Stanko Subotic tried to turn Montenegro into the new Monaco by buying the choicest coastal property and promising luxury resorts. But to do it he borrowed almost €21 million from the Prime Minister’s family bank.

Subotic had borrowed from First Bank for a variety of businesses. While San Investments continuously failed to repay its loans, another of Subotic’s companies, Belgrade-based Futura Plus, a huge kiosk chain and media distributor, applied in mid-September 2008 for a tender to privatize Duvankomerc, a Montenegrin tobacco retailer. Despite offering just €2.1 million (US$ 2.9 million)—another bidder offered three times as much— he won the bid. After several delays in signing the contract, on Nov. 10, 2008 his company withdrew from the privatization.

Subotic’s companies and the bank were broke.

Two weeks later, the Djukanovics’ bank asked the government for a €44 million (US$ 56.7 million) short-term liquidity loan to save the bank. Not only had the Djukanovics’ cash machine for the privileged run out of funds, it owed €32 million (US$ 41.2 million) to creditors and depositors.

The bailout was granted on Dec. 11. Montenegrin citizens picked up the tab for First Bank’s transgressions. While the bank claims to have repaid citizens, OCCRP found that is in doubt.

They might not have needed to.

First Bank allowed Saric, Subotic and others who were responsible for the bank collapse to withdraw their deposits—the very deposits which should have secured their loans.

The move was just another example of the strong interconnected business relationships between Saric, Subotic and Djukanovic.

In January 2009 examiners wrote that the bank did not collect money from deposits, “despite the fact it would be (by far the) easier and faster way to collect the debt.” The Central Bank demanded First Bank liquidate its bad loans and collect on the collateral, much of which was of questionable value especially when it involved loans to powerful people.

The government bailout loan did not solve the bank’s problems.

On Feb. 1, 2009, the First Bank announced it was selling Subotic’s island for the starting price of €28 million (US$ 35.9 million). One day later Samuelson Corporation issued a press release stating it was withdrawing from Montenegro, blaming its inability to obtain necessary permits. Debt was never mentioned.

Under pressure from the Central Bank, the property was put up for auction. The first auction failed. Two more followed and also failed. No one publicly expressed interest in buying Subotic’s land.

But behind the failed auction, a secret deal was being set up to that avoided future auctions of the valuable land.

Another Prime Minister Enters the Picture

In April 2009, Thaksin Shinawatra, former prime minister of Thailand, through a Dubai lawyer deposited €15 million in First Bank, which put him among bank’s top five depositors in 2009.

Sinavatra – Photo by Vijesti

On March 17, 2009, the Central Bank called for the government to take over First Bank which it said needed €110.6 million more just to stay alive. The bank along with its biggest depositors and debtors, the most powerful people in the country, were in serious financial troubles. They looked outside.

On April 20, 2009, Thaksin Shinawatra, former prime minister of Thailand, arrived in Liberia holding a Montenegrin passport. It was a difficult period in Shinawatra’s life. He had been removed from office in a 2006 coup and went into self-imposed exile. But Shinawatra had been facing more difficult problems — five days earlier his Thai passport had been revoked.

According to Montenegrin law, a person may be granted citizenship in Montenegro as long as he or she has not been sentenced to a prison term. However, Shinawatra had been convicted in absentia for corruption, and Interpol had issued a warrant for his arrest. He got citizenship anyway.

The records show that at this very time when Interpol was looking for Shinawatra, €15 million (US$19.8 million) of Shinawatra’s money ended up in First Bank, deposited by a lawyer from Dubai named Khalid M. Kadfoor Al-Mehairi. Montenegrin officials refused to answer questions about how his citizenship was approved or by whom.

The money was vital for First Bank which was in its most critical state, with no cash or way out, and the Central Bank was calling for its liquidation.

Al-Mehairi never filled out a form that banks are obliged to complete for all depositors. A year and a half later, court records revealed that the lawyer made the deposit on behalf of Shinawatra.

According to court records, Shinawatra, who had made money selling his Manchester City football team, had asked the lawyer to do a number of business transactions for him. These included buying a house in Dubai, and opening an account in his name in a bank in Montenegro.

Due to the Interpol warrant which was still outstanding, Al-Mehairi convinced Shinawatra to open the account in Al-Mehairi’s name rather than Shinawatra’s so the money couldn’t be seized. Later Shinawatra’s conviction and warrant would both be withdrawn.

Al-Mehairi deposited the money in April 2009, but the arrangement did not end well.